estate tax exemption 2022 proposal

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. Reducing the estate and gift tax exemption to 6020000 effective January 1 2022.

What Happened To The Expected Year End Estate Tax Changes

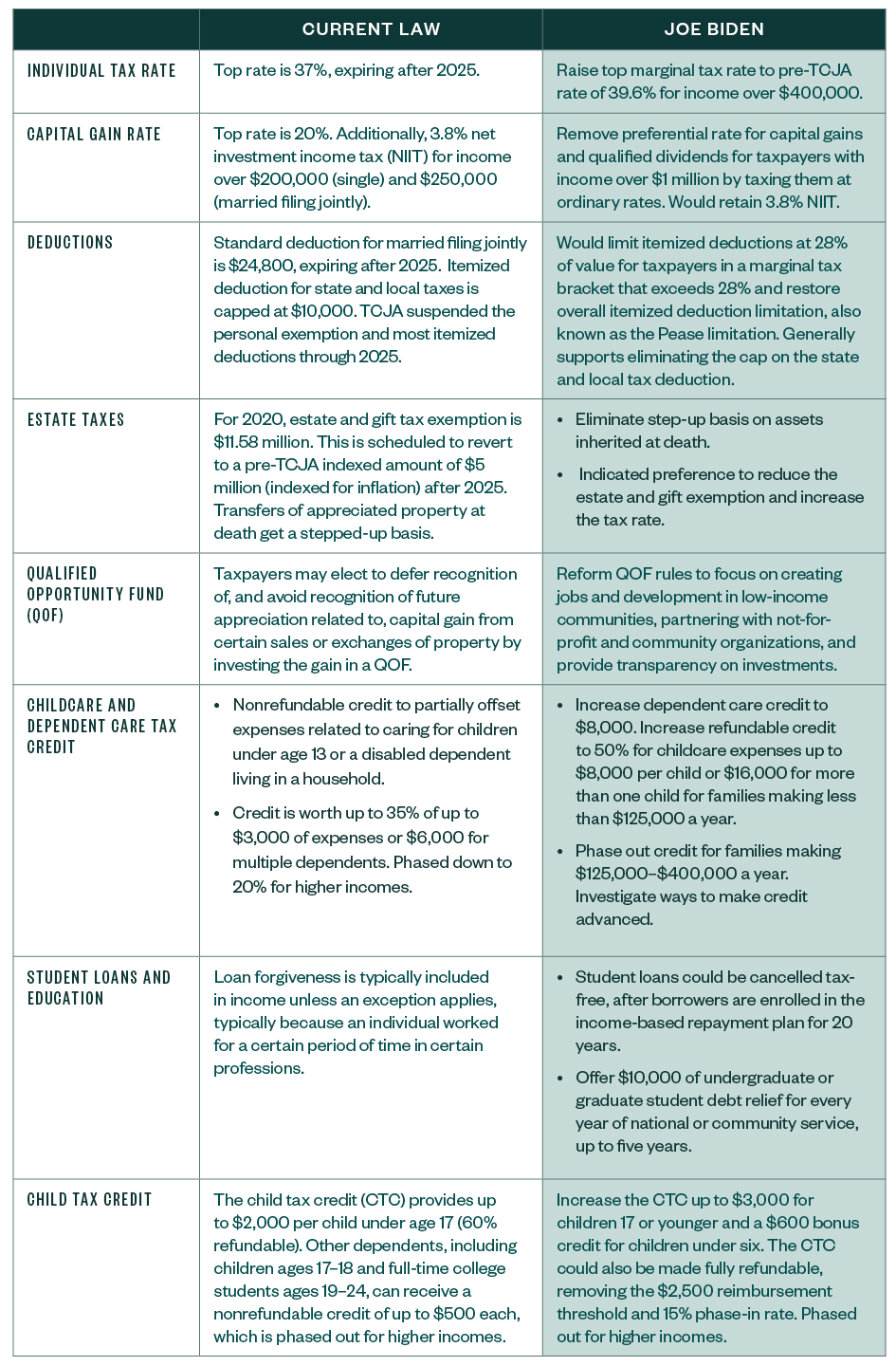

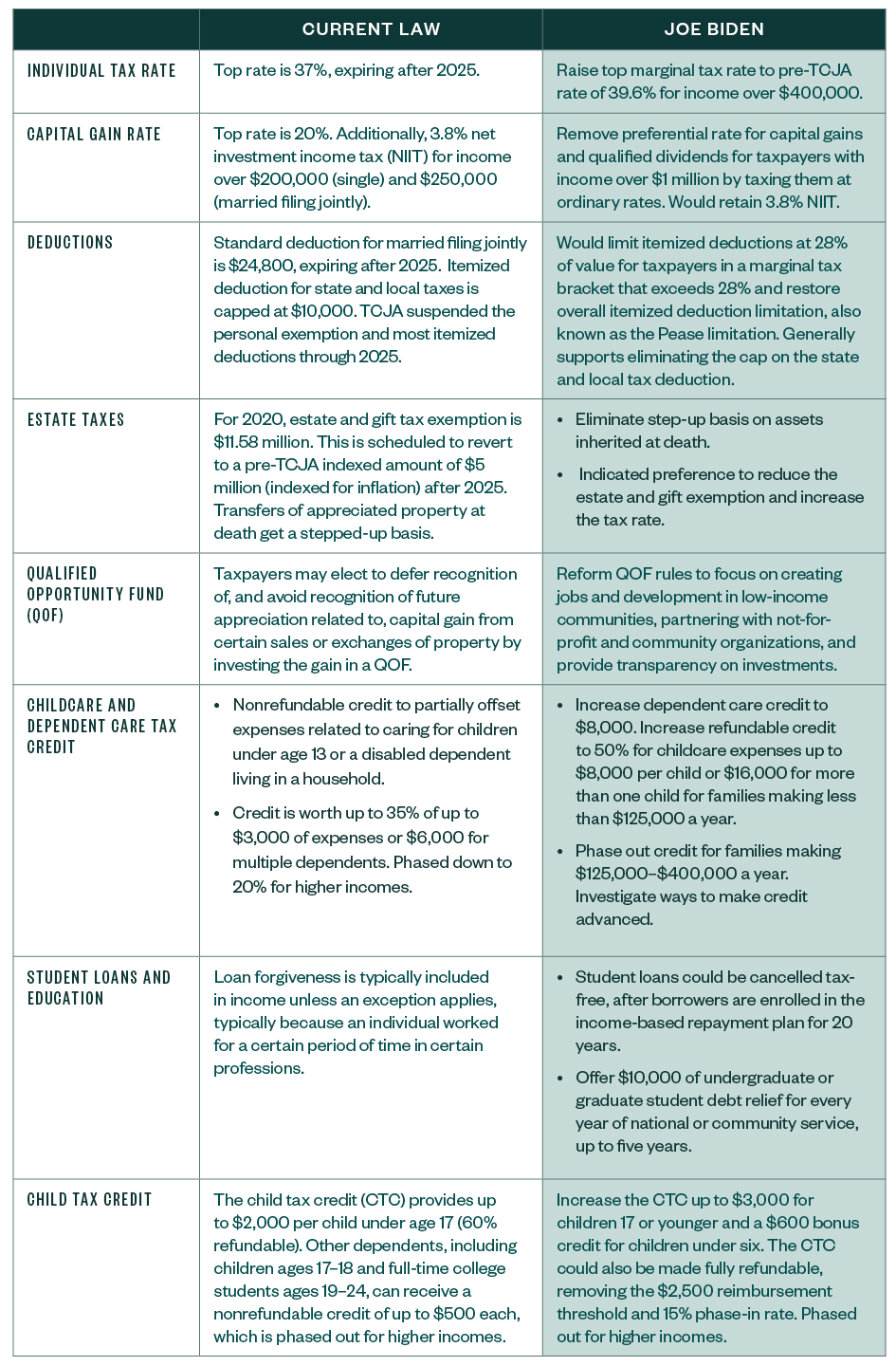

President Biden recently released his FY2023 Budget and the US.

. The revenue proposals are described in the Treasury Departments General Explanation of the Administrations Fiscal Year 2023 Revenue Proposals commonly referred to as the Treasury Green Book which accompanied the budget recommendations. A number of these items affect estate and gift tax-related issues. The proposals would also see the top tax rate increase to 45 from 40.

The federal estate tax exemption for 2022 is 1206 million. The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. Bidens Latest Estate Tax Exemption Proposal.

Under current law this reduction was scheduled to occur after December 31 2025 but this proposal makes that change happen at the end of this year instead. Subjecting grantor trusts to estate tax. As of January 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately 6020000 per person or 12040000 for a married couple.

However If the donor dies in 2026 the remaining 3500000 would be subject to estate taxes. As of January 1 2022 that will be cut in half. Bernie Sanders has proposed that the exemption come down to 3500000 and not increase with inflation thereafter but this is not mentioned in the new plan.

1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for inflation. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Severely limiting the effectiveness of GRATs QPRTs SLATs and.

A temporary doubling of the estate tax exemption is currently set to expire in 2026. The package proposed reducing the current 117 million estategift tax exemption by 50 percent on January 1 2022 eliminating the use of valuation discounts for non-operating businesses and. The proposal includes increased income tax for individuals from a top rate of 37 to 396 and for C corporations from 21 to 28.

The new exemption amount would be 5 million indexed for inflation dating back to 2010. From Fisher Investments 40 years managing money and helping thousands of families. Heirs paid 94 billion in estate taxes in 2016 according to the Joint Committee on Taxation.

Previously this reduction was not scheduled to take place until January 1 2026. Reduction of Estate Gift and GST Tax Exemptions as of January 1 2022 Under current law the exemption for estate gift and generation skipping transfer GST tax of 11700000 reverts back to 5 million which when indexed for inflation would be approximately 6020000 in 2022 for decedents dying and gifts made after December 31 2025. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax.

You are correct that the 5000000 gift will be given full credit and assuming there is no tax law change the remaining amount will be free of estate tax with a 2022 death. The latest word from the Biden administration is that the estate tax exemption will be reduced effective January 1 2022 from the current 117 million per person enacted by the Trump administration in 2017 to the previous Federal limit of 5 million adjusted for inflation. Under the Plan the current Lifetime Exemption will be reduced to 5000000 per person or 10000000 for married couples and adjusted for inflation to 6000000 per person or 12000000 for married couples.

The Biden administration intends to revert the 117 million exemption to its pre-2010 limit of 35 million 7 million for couples accelerating the TCJA sunset date to early 2022. 24 rows On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is. A provision of the proposed legislation that would become effective Jan.

The estate tax exemption is adjusted for inflation every year. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

Some proposals would have sidelined a number of established estate planning strategies while other proposals could have increased the frequency of use and usefulness of others. November 22 2021 at 1028 am. If enacted the current 117 million per person estate and gift tax exemption would be reduced to 602 million for 2022 based on current estimates.

Another proposal is to increase long-term capital gain and qualified dividend rates to. Treasury provided details regarding the related revenue provisions. Some proposals would have reduced the estate and gift tax exemption amount from its current level of 1206 million per taxpayer to 35 685 million per taxpayer depending on.

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

A Review Of Us President Elect Joe Biden S Tax Proposals

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Administration May Spell Changes To Estate Tax Exemptions And Basis Step Up Rule

Tax Proposals Under The Build Back Better Act Version 2 0

What The 2021 Tax Proposals Mean The American Families Plan Cpa Practice Advisor

What Can The Wealthy Do About Biden S Proposed Tax Increases

Biden Greenbook Estate Tax Proposals Should You Care

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

The New Death Tax In The Biden Tax Proposal Major Tax Change

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

Minimum Tax Proposal Would Create Complications For Investors And Companies Tax Experts Say Wsj

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

10 Sweetest Poetries To Propose And Get Your Love In 2022 Proposal Best Poetry Lines Propose Day

Estate Taxes Under Biden Administration May See Changes

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

New Tax Proposals Mean Some Should Review Their Estate Plans